Storing commodities: transformation in time

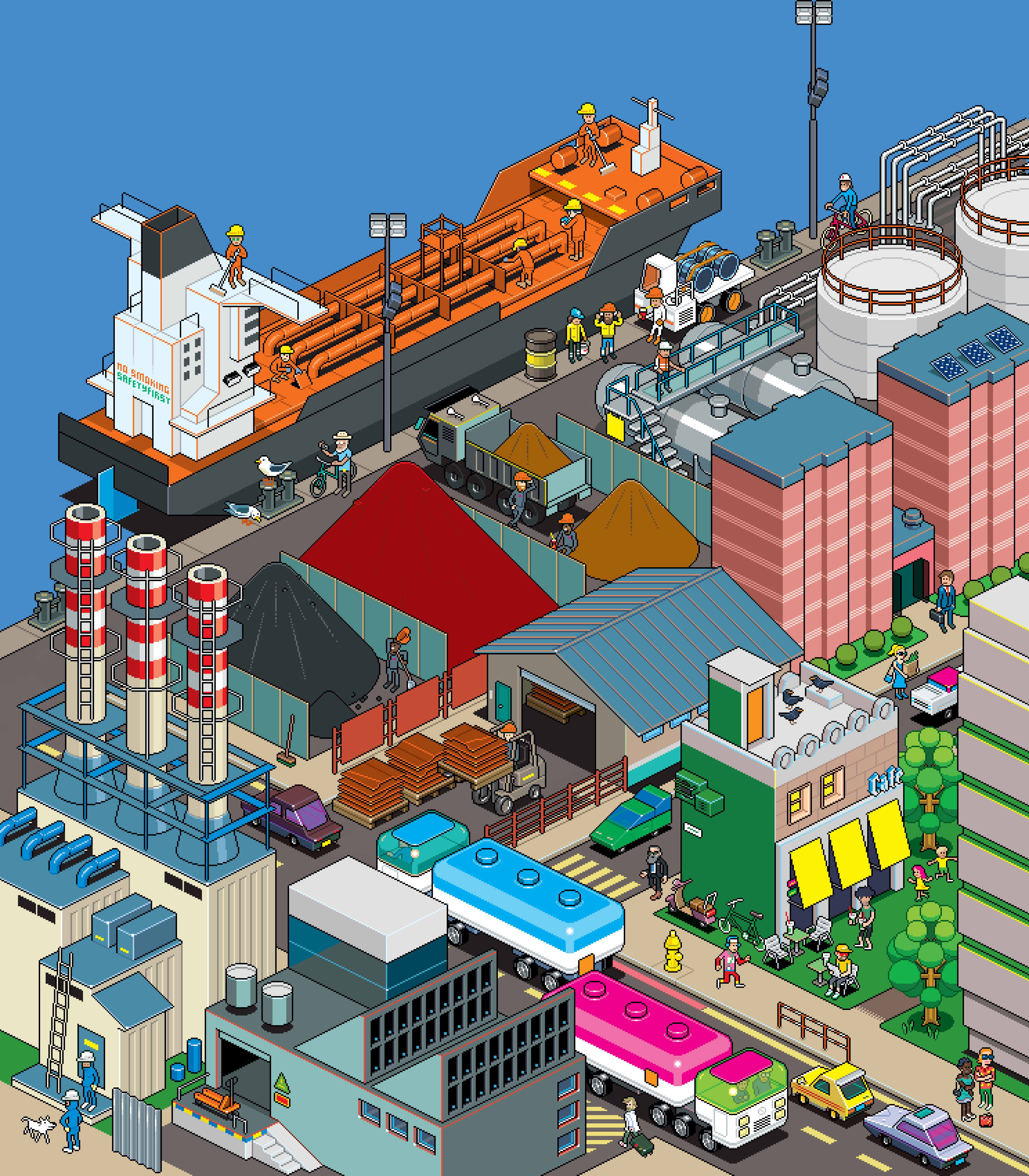

With inelastic supply and demand in commodity markets, supply and demand shocks have the potential to create very volatile market conditions. Trading firms store commodities to help bridge this gap and keep markets in balance. They own and control midstream infrastructure and maintain large inventories at strategic locations around the globe. Traders earn profits over time by reducing stocks when there is excess demand and building up inventory when there is excess supply.

Storing commodities: transformation in time

With inelastic supply and demand in commodity markets, supply and demand shocks have the potential to create very volatile market conditions. Trading firms store commodities to help bridge this gap and keep markets in balance. They own and control midstream infrastructure and maintain large inventories at strategic locations around the globe. Traders earn profits over time by reducing stocks when there is excess demand and building up inventory when there is excess supply.

Contango and backwardation

A trader can buy a commodity for delivery on a date in the future in one of two ways. He could either borrow money now to buy the commodity today, and store it until the desired delivery date or he could buy a commodity futures contract. When futures price drift higher than spot prices, markets move into contango. The opposite situation, when futures fall below the current spot price, is known as backwardation.

The brent futures curve moved from backwardation in May 2014 to contango in May 2015 to super contango by November 2015 and back to contango by May 2016.